A penalty for not having health insurance still applies in some places. Does the calculator provide definitive results for the tax penalty i will owe if i go without health insurance in 2018.

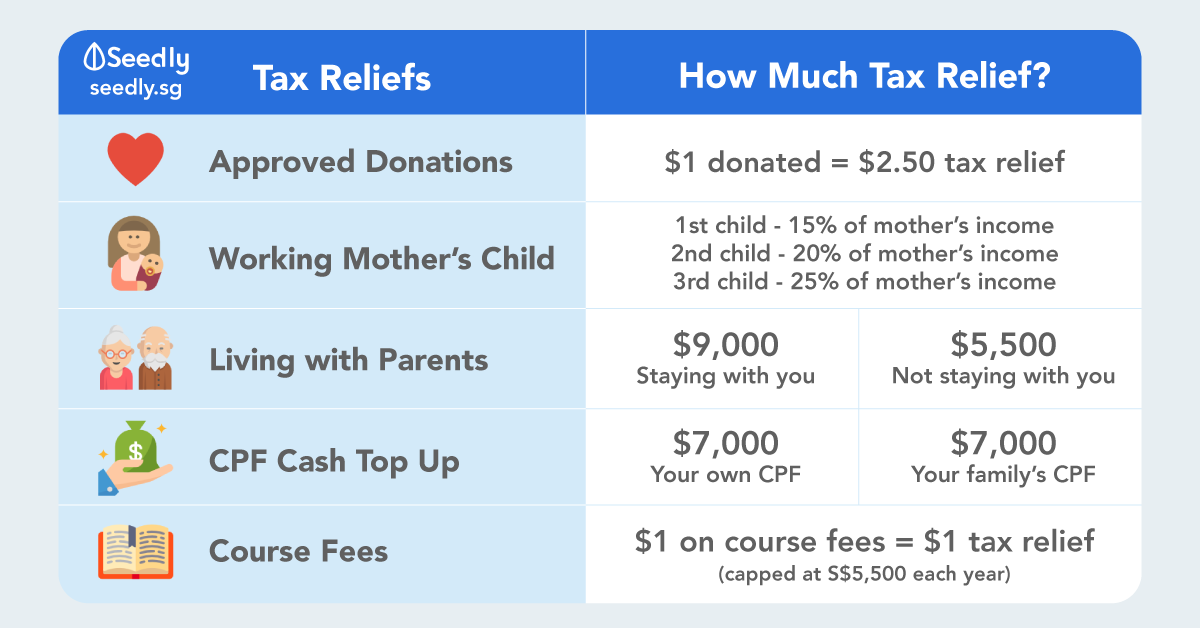

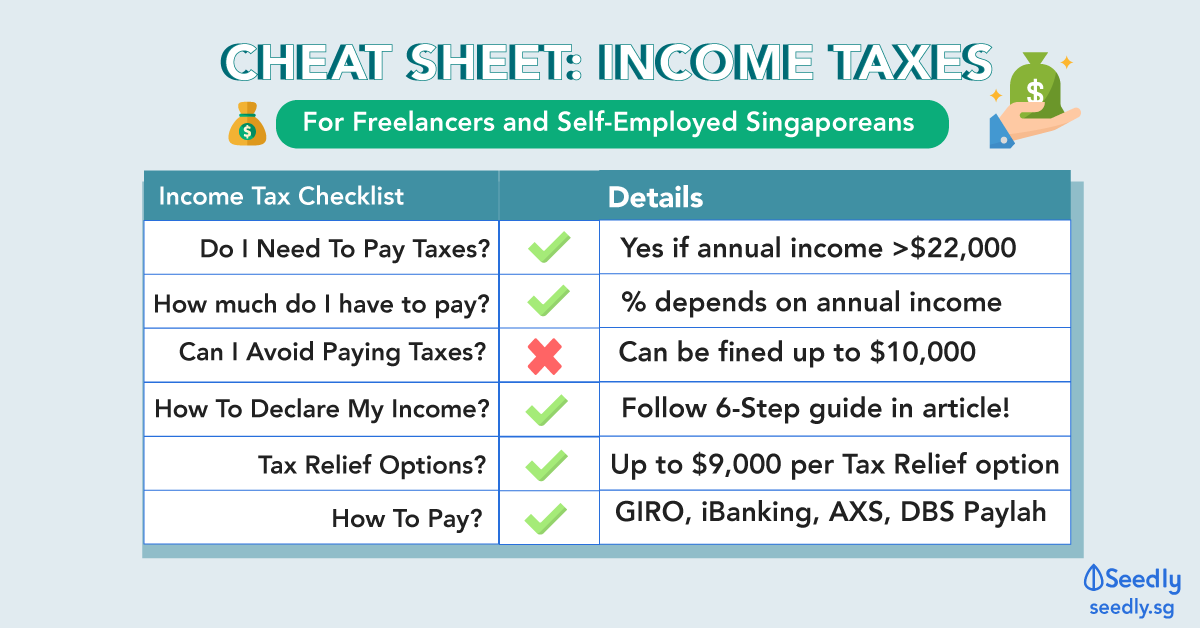

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

2018 tax penalty for no health insurance calculator

2018 tax penalty for no health insurance calculator is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 2018 tax penalty for no health insurance calculator content depends on the source site. We hope you do not use it for commercial purposes.

The shared responsibility payment for 2018.

2018 tax penalty for no health insurance calculator. It can be 1 of your gross income for a year. The calculator is intended to show you an estimate of your penalty for. Use this calculator to estimate your 2018 aca penalty.

So even though the penalty was eliminated after 2018. From 2014 through 2018 the federal form 1040 included a line where filers had to indicate whether they had health insurance for the full year see the upper right corner under the spaces for social security numbers. If you could afford health insurance in 2018 but did not purchase coverage you will likely have to pay a penalty amounting to either 25 percent of your yearly household income or 695 per person 34750 per child under 18 whichever is greater.

Be sure to check if you qualified for an exemption to avoid an obamacare fine if you were without health insurance in 2018. Under the affordable care act taxpayers who do not have minimum essential health insurance coverage or qualify for an exemption were required to pay a penalty on their tax return. Through the 2018 plan year most people must have qualifying health coverage or pay a fee sometimes called the mandate shared responsibility payment or penalty for the months they dont have insurance.

Irs data shows at least 4 million taxpayers paid the healthcare penalty for tax year 2016 and at least 56 million paid the penalty for tax year 2015. Tax returns filed in 2019 for the 2018 tax year still included penalty assessments. But if you qualify for a health coverage exemption you dont need to pay the fee.

Hang on to that money by seeing how you can buy affordable insurance. Aca individual mandate penalty calculator. The penalty for not having health insurance in 2018 is expected to be 695 per adult and 34750 per child up to 2085 for a family or its 25 of your household income above the tax return filing threshold for your filing status whichever is greater.

For plan years through 2018 if you can afford health insurance but choose not to buy it you may pay a fee called the individual shared responsibility payment when you file your federal taxes. Above is the combined obamacare fine estimate for everyone included on your tax return. The draft form 1040 for 2019 no longer includes that question as theres no longer a penalty for being without coverage.

While the requirement to have health insurance remains the tax cuts and jobs act eliminated the penalty starting in 2019. The fee is sometimes called the penalty fine or individual mandate. The penalty for not getting health insurance may be more than you think.

Health Insurance Coverage Still Required In 2018

Health Insurance Coverage Still Required In 2018

Health Insurance Marketplace Calculator The Henry J Kaiser

Health Insurance Marketplace Calculator The Henry J Kaiser

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Itr Filing Penalty Penalty You Will Pay For Missing Itr Filing

Itr Filing Penalty Penalty You Will Pay For Missing Itr Filing

Late Itr Filing Penalty On Late Filing Of Itr And Other Tax

Late Itr Filing Penalty On Late Filing Of Itr And Other Tax

Singapore Personal Income Tax Rikvin

Singapore Personal Income Tax Rikvin

China Individual Income Tax Iit Reform 2018 October Hrone

China Individual Income Tax Iit Reform 2018 October Hrone

What Is The 2018 Maximum Social Security Tax The Motley Fool

What Is The 2018 Maximum Social Security Tax The Motley Fool

China Individual Income Tax Iit Reform 2018 October Hrone

China Individual Income Tax Iit Reform 2018 October Hrone

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

How To Calculate Deferred Tax In Line With Ifrs

How To Calculate Deferred Tax In Line With Ifrs

0 comments